Historic volume of transactions in the first quarter

[20.04.2021]Despite all the restrictions art market professionals have faced, Q1 2021 ended with a historic record in terms of the number of lots sold on the auction market.

During the first quarter of 2021, more than 112,000 artworks changed hands in auction sales around the world. This remarkable figure illustrates the strong growth dynamic of an art market that is continually attracting new buyers.

The substantial growth in transactions – up 18% compared with Q1 2020 – is of course largely due to a favorable comparison effect resulting from the negative impact of the first wave of the pandemic a year earlier, which forced an abrupt interruption of auction house activity before they switched to online sales. Nevertheless, the transaction volume in Q1 2021 was 6% better than in Q1 2019, which also saw a historic number of transactions.

The number of transactions has doubled in 10 years

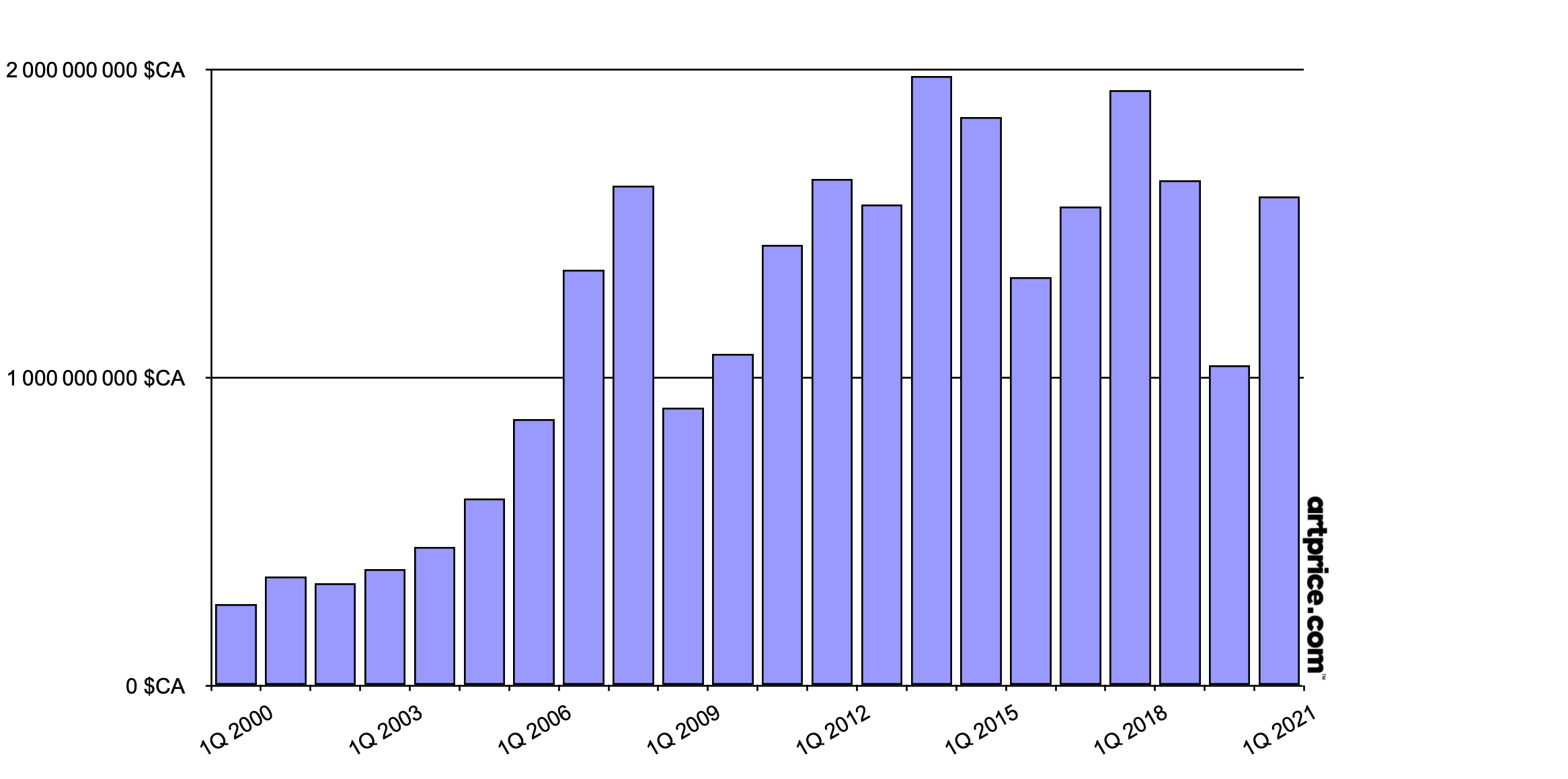

To appreciate the speed of this growth we need to roll back the clock to the beginning of the century. In the early 2000s, auction companies around the world dispersed an average total of 42,000 lots generating $400 million over a quarterly period. Then in 2006-2010 the average Q1 turnover reached one billion dollars (with 51,000 lots sold), followed by 1.6 billion during the last decade, with an average of 82,000 works sold in first quarter sales.

The most dynamic countries (Q1 2021)

- United States: 25,000 works sold

- France: 18,000 works sold

- United Kingdom: 15,000 works

- Italy: 7,000 works sold

- Germany: 6,000 works sold

For this last quarter, the overall turnover was in line with the ten-year average ($1.6 billion) but with a significantly higher number of transactions (+37%). Clearly, the high-end market was much thinner than before the pandemic, but the works exchanged were much more numerous, substantially more affordable, and quite clearly more adapted to demand, with a historically high sold through rate of 75% compared with 67% on average in previous years.

Table. Evolution of first quarter Fine Art auctions

16 lots fetched over $10 million each during Q1 2021

With Sandro BOTTICELLI’s renaissance portrait in first place at $92 million and BEEPLE’s Jpeg file in second place at $69.3 million, the two most expensive works of the first quarter illustrate the many facets of a highly liquid art market. At one end of the spectrum, historical masterpieces are still resonating with buyers and still exerting their power of fascination. At the other, an “all-digital” market has emerged that resembles a playground for HNWIs for whom a virtual art collection is just as natural as a portfolio of financial assets.

The eight other results above the $10 million threshold were primarily hammered for Modern creations, from the end of the 19th century to the first half of the 20th. Pablo PICASSO remains the most frequent signature in this price range, with three paintings sold at the end of March in London. There were also two works by Vincent VAN GOGH (including a small drawing measuring 31 cm (Le Mousmé); a work by the highly sought-after René Magritte (whose price index rose 64% last year) and works by Frantisek KUPKA, Arshile GORKY and Edvard MUNCH.

More unexpectedly, a painting by Winston CHURCHILL that used to belong to Brad Pitt & Angelina Jolie also generated one of the top results of the quarter (Tower of the Koutoubia Mosque). The glamorous provenance of this work seems to have played a decisive role as the work by the former British Prime Minister quadrupled his previous auction record!

In addition, two Contemporary artists stood out with excellent results: Basquiat twice, and Banksy, who practically doubled his previous record with the sale of Game Changer for $23.2 million. This exceptionally high price was no doubt substantially fuelled by the charitable cause of the work’s sale with all of the money it generated including some of the buyer premium (i.e. $22 million) being donated to “health organisations and charities across the UK that enhance the care and treatment provided by the National Health System”.

A year after the health crisis first upset the organization of the art market in the West, the results are again encouraging in the high-end segment. The 10 best results of the first quarter are significantly higher than those obtained last year, and the overall value of this Top 10 was almost doubled to 325 million (versus $169 million in 2020).

Top Fine Art auction results in the first quarter of 2021

| Rank | Artist | Price ($) | Title | Auctioneer |

|---|---|---|---|---|

| 1 | Sandro BOTTICELLI | 92 184 000 $ | Portrait of a young man holding a roundel | Sotheby’s, New York |

| 2 | BEEPLE | 69 346 250 $ | EVERYDAYS: THE FIRST 5000 DAYS | Christie’s, New York |

| 3 | Jean-Michel BASQUIAT | 41 658 300 $ | Warrior | Christie’s, Hong Kong |

| 4 | BANKSY | 23 238 700 $ | Game Changer | Christie’s, London |

| 5 | Edvard MUNCH | 22 378 890 $ | Summer Day or Embrace on the Beach | Sotheby’s, London |

| 6 | Pablo PICASSO | 20 221 900 $ | Femme nue couchée au collier |

Christie’s, London |

| 7 | Vincent VAN GOGH | 15 414 600 $ | Scène de rue à Montmartre | Sotheby’s & Mirabaud-Mercier, Paris |

| 8 | Joan MIRO | 14 082 980 $ | Peinture | Christie’s, London |

| 9 | René MAGRITTE | 13 767 780 $ | Le mois des vendanges | Christie’s, London |

| 10 | Pablo PICASSO | 13 394 350 $ | Femme assise dans un fauteuil noir (Jacqueline) | Christie’s, London |

| copyright © 2021 artprice.com | ||||

0

0