H1 2018 – Global Art Market Report, by Artprice.com

Artprice presents

H1 2018 Global Art Market Report:

All economic indicators are positive

- Global auction turnover on Fine Art* rose 18%, totalling $8.45 billion

- Transactions remained stable with 262,000 lots sold, up 2.5% vs. H1 2017

- The USA posted a massive 48% increase, with total turnover of $3.3 billion

- China**, with $2 billion in turnover, reduced its unsold rate before a decisive H2

- The UK is just behind China with auction turnover up 18% to $1.9 billion,

- The EU is contributing to growth: France +8%, Germany +17%, Italy +22%

- Modern Art, the high-end market’s mainstay, accounted for 46% of total turnover

- Modigliani and Picasso both generated results above the $100 million threshold

- Zao Wou-Ki was China’s best-performer in H1 2018 with turnover of $155 million

- Contemporary Art’s global price index rose 27%, rivalling the S&P 500

*Fine Art Public Auction: painting, sculpture, drawing, photography, prints, installation

**In collaboration with the Art Market Monitor of Artron (AMMA)

A new worldwide stability

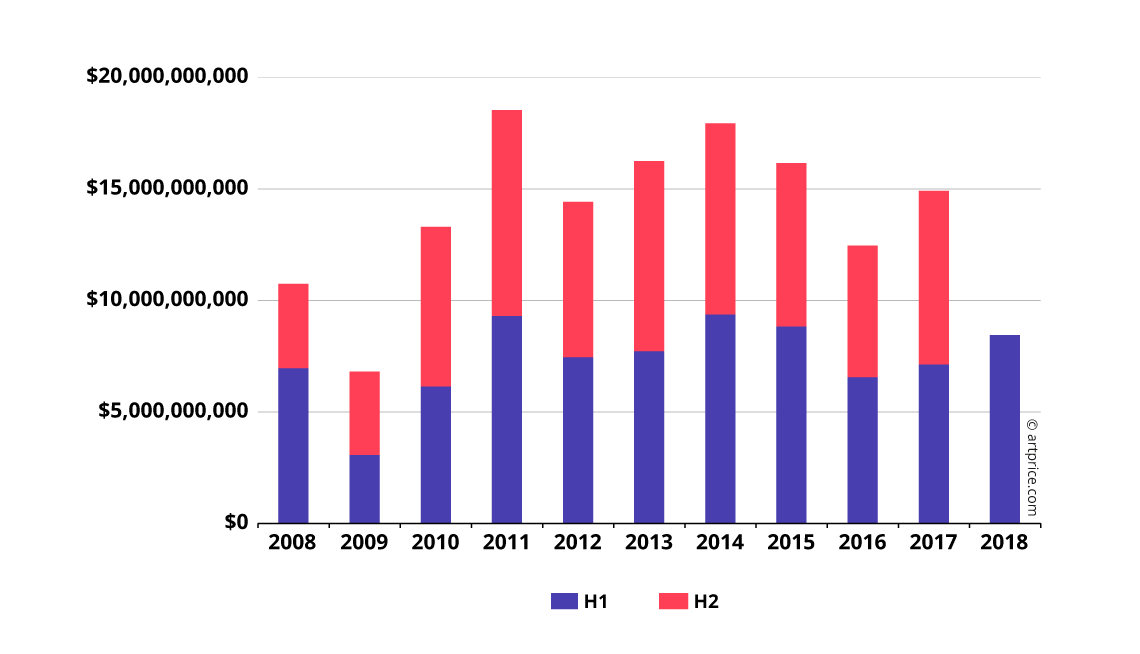

Global Fine Art auction turnover amounted to $ 8.45 billion in H1 2018, an increase of 18% versus the year earlier period. The Art Market is therefore pursuing the renewed growth which started in H1 2017 (+9%) and was confirmed in H2 2017 (+32%).

Semi-annual evolution of Fine Art auctions

Compared with the financial crisis in 2008 – and its repercussions on art prices the following year – the Art Market appears to have considerably matured and is now enjoying a new form of stability and independence. This stability is based on a very large volume of transactions: over 250,000 lots auctioned each semester, effectively constituting a solid basis for the International Art Market.

The annual differences we observe in total global auction turnover from Fine Art are essentially generated by a limited number of top-bracket lots which constitute only a fraction of the number of transactions: results above the $5 million threshold represent less than 0.1% of the transactions, but generate 40% of the turnover. This high-end market depends more than any other on the level of confidence within the market, as well as the general economic context. In fact, judging by the 229 works which sold above the $5 million threshold in H1 2018, the market perceives the current economic situation as particularly favorable: in H1 2017 the number was only 163.

The ultra-high-end market, i.e. a handful of extremely rare works (> $100 million) that are usually offered for sale in extraordinary circumstances, now also has an impact on global annual turnover totals. The $450

million paid by the Emirate of Abu-Dhabi for Leonardo da Vinci’s Salvator Mundi masterpiece last November, alone accounted for 3% of 2017’s total global auction turnover from Fine Art.

The USA again leader thanks to Modern Art

In the first half of 2018, the major Anglo-Saxon auction houses managed to maintain the enthusiasm generated by the historical sale of Salvator Mundi. The dispersion of the Rockefeller Collection gave Christie’s an excellent opportunity to start the prestigious New York spring sessions in spectacular style. The sale of 8 May 2018 alone totalled $646 million, including $115 million (incl. buyer’s fees) for one of the last canvases from Pablo Picasso’s ‘Blue Period’ still in circulation, Fillette à la corbeille fleurie (1905).

The Rockefeller Collection – the most valuable private collection ever sold – featured a prodigious number of other early 20th-century masterpieces including Claude Monet’s Nymphéas en fleur (c.1914-1917) and Henri Matisse’s Odalisque couchée aux magnolias (1923) which fetched $85 million and $81 million respectively. A few days later, on 14 May, Modern Art continued proving its power of attraction with the sale of Amedeo Modigliani’s Nu couché (sur le côté gauche) (1917) for $157 million at Sotheby’s in New York.

With 47,000 lots sold over the year’s first six months (up 9% vs. the year earlier period), the USA remains the world’s leading art marketplace ahead of France (41,500), China (36,000) and the United Kingdom (29,000). Nearly one fifth of the works auctioned worldwide are sold in the United States, and while 48% of Fine Art auction lots sold in the USA fetch less than $1,000, New York is home to the largest high-end art market in the world: the top six first-half results were hammered in Manhattan (all during May).

Top 10 results – S1 2018

| Artist | Artwork | Price (USD) | Sale | ||

|---|---|---|---|---|---|

| 1 | Amedeo MODIGLIANI (1884-1920) | Nu couché (sur le côté gauche) (1917) | $157,159,000 | May 14, 2018 | Sotheby’s New York |

| 2 | Pablo PICASSO (1881-1973) | Fillette à la corbeille fleurie (1905) | $115,000,000 | May 8, 2018 | Christie’s New York |

| 3 | Kasimir Sevrinovitch MALEVICH (1878-1935) | Suprematist Composition (1916) | $85,812,500 | May 15, 2018 | Christie’s New York |

| 4 | Claude MONET (1840-1926) | Nymphéas en fleur (c.1914-1917) | $84,687,500 | May 8, 2018 | Christie’s New York |

| 5 | Henri MATISSE (1869-1954) | Odalisque couchée aux magnolias (1923) | $80,750,000 | May 8, 2018 | Christie’s New York |

| 6 | Constantin BRANCUSI (1876-1957) | La jeune fille sophistiquée (1928) | $71,000,000 | May 15, 2018 | Christie’s New York |

| 7 | Pablo PICASSO (1881-1973) | Femme au bére et à la robe quadrillée (1937) | $68,702,214 | Feb 28, 2018 | Sotheby’s London |

| 8 | Pablo PICASSO (1881-1973) | La Dormeuse (1932) | $57,829,046 | Mar 8, 2018 | Phillips London |

| 9 | Francis BACON (1909-1992) | Study for Portrait (1977) | $49,812,500 | May 17, 2018 | Christie’s New York |

| 10 | Jean-Michel BASQUIAT (1960-1988) | Flexible (1984) | $45,315,000 | May 17, 2018 | Phillips New York |

| copyright ©2018 artprice.com | |||||

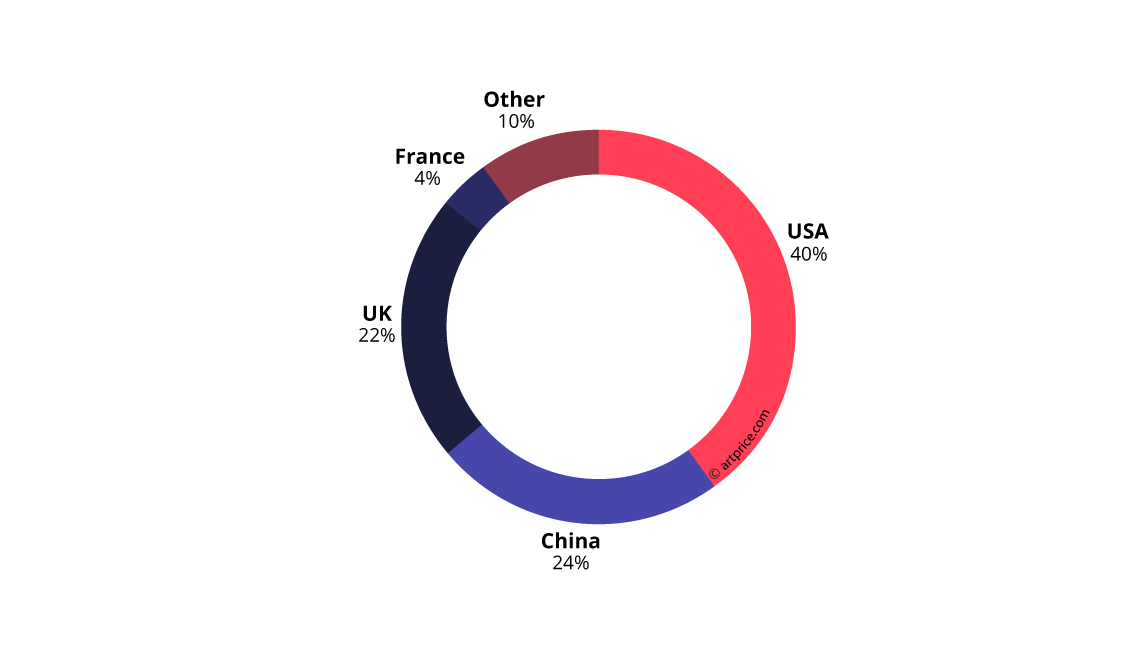

With its extremely dynamic market and unmatched high-end offer, New York was by far the leading marketplace in the global art market in H1 2018. Posting a total turnover growth of +48%, the American market generated for $3.3 billion in auction turnover in H1 2018. Representing 40% of the total value of the world’s Fine Art auction turnover in H1 2018, this figure brings the United States back into first place on the global art market… at least temporarily.

H1 2018 Geograpical distribution of the Fine Art Market

London capable of competing with New York

After an uncertain year 2016, the English Art Market no longer seems weakened by the Brexit process and is once again demonstrating excellent health. The United Kingdom looks set for a second consecutive year of growth: its Fine Art auction total already stands at $1.9 billion for the first half, compared with $2.5 billion for full-year 2017. And the second half has Frieze week (4 – 7 October 2018) accompanied by a flurry of prestige sales, marking the resumption of auction sales after the summer recess around the world…

The English capital continues to compete with New York on the high-end market, especially for major European signatures. London remains the world’s leading marketplace for works by Gerhard Richter, the most successful living artist on the global Art Market, but also for works by Pablo Picasso. Indeed, Picasso alone accounted for 17% of the total Fine Art auction turnover generated in the UK during H1 2018 (compared with 8% in the USA).

But London has also become an unavoidable marketplace for the American stars of Post-War and Contemporary art. Masterpieces by Andy Warhol and Jean-Michel Basquiat are frequently put on sale in London. On the other hand, the best works by David Hockney, Lucian Freud and even Damien Hirst are increasingly being sold on the other side of the Atlantic.

H1 2018 Geograpical distribution of sales revenue of the 20 best performing artists

| Geographic distribution | ||||||

|---|---|---|---|---|---|---|

| Artist | Turnover | New York | London | Hong Kong | Other | |

| 1 | Pablo PICASSO (1881-1973) | $602,865,747 | 42 % | 54 % | 0 % | 4 % |

| 2 | Claude MONET (1840-1926) | $267,055,149 | 68 % | 32 % | 0 % | 0 % |

| 3 | Andy WARHOL (1928-1987) | $175,393,487 | 65 % | 31 % | 0 % | 4 % |

| 4 | Jean-Michel BASQUIAT (1960-1988) | $162,756,656 | 54 % | 40 % | 5 % | 1 % |

| 5 | Amedeo MODIGLIANI (1884-1920) | $160,869,523 | 99 % | 1 % | 0 % | 0 % |

| 6 | ZAO Wou-Ki (1921-2013) | $154,558,288 | 1 % | 0 % | 69 % | 30 % |

| 7 | Henri MATISSE (1869-1954) | $144,675,227 | 77 % | 22 % | 0 % | 1 % |

| 8 | ZHANG Daqian (1899-1983) | $107,478,086 | 12 % | 0 % | 35 % | 53 % |

| 9 | Kasimir MALEVICH (1878-1935) | $96,248,783 | 89 % | 11 % | 0 % | 0 % |

| 10 | Joan MIRO (1893-1983) | $87,818,817 | 80 % | 18 % | 0 % | 2 % |

| 11 | Gerhard RICHTER (1932-) | $80,720,365 | 38 % | 51 % | 5 % | 6 % |

| 12 | David HOCKNEY (1937-) | $77,358,842 | 66 % | 34 % | 0 % | 0 % |

| 13 | Alberto GIACOMETTI (1901-1966) | $73,528,071 | 50 % | 48 % | 0 % | 2 % |

| 14 | Francis BACON (1909-1992) | $73,156,871 | 69 % | 30 % | 0 % | 1 % |

| 15 | Constantin BRANCUSI (1876-1957) | $71,921,220 | 99 % | 1 % | 0 % | 0 % |

| 16 | QI Baishi (1864-1957) | $64,402,510 | 2 % | 0 % | 7 % | 91 % |

| 17 | Paul GAUGUIN (1848-1903) | $63,511,735 | 92 % | 6 % | 0 % | 2 % |

| 18 | Fernand LÉGER (1881-1955) | $62,655,125 | 74 % | 14 % | 0 % | 12 % |

| 19 | Richard DIEBENKORN (1922-1993) | $62,311,216 | 100 % | 0 % | 0 % | 0 % |

| 20 | Yayoi KUSAMA (1929-) | $61,861,631 | 11 % | 10 % | 47 % | 32 % |

| copyright ©2018 artprice.com | ||||||

London and New York together accounted for 80% of the high-end market in the year’s first half. Of the 107 results above $10 million, 51 were hammered in New York, 37 in London, 8 in Beijing, 8 in Hong Kong, 2 in France and 1 in Tokyo.

However New York continues to attract all the absolutely extraordinary pieces. To date, only one work has exceeded the symbolic threshold of $100 million in London: Alberto Giacometti’s L’homme qui marche I (1960) sculpture which sold at Sotheby’s on 3 February 2010. The $100 million threshold has already been crossed 13 times in New York.

In October 2017, during the Frieze week, Christie’s in London failed to sell a major work by Francis Bacon: Study of Red Pope 1962. 2nd Version (1971) estimated at $130 million. In fact Francis Bacon’s three best-ever auction results were all hammered in New York, where this year again, nearly 70% of the Irish painter’s auction turnover has so far been generated.

Historical Auctions above the $100M

| Artist | Artwork | Price (USD) | Sale | ||

|---|---|---|---|---|---|

| 1 | Leonardo Da VINCI (1452-1519) | Salvator Mundi (c.1500) | $450,312,500 | Nov 15, 2017 | Christie’s New York |

| 2 | Pablo PICASSO (1881-1973) | Les femmes d’Alger (Version ‘O’) (1955) | $179,365,000 | May 11, 2015 | Christie’s New York |

| 3 | Amedeo MODIGLIANI (1884-1920) | Nu couché (1917-1918) | $170,405,000 | Nov 9, 2015 | Christie’s New York |

| 4 | Amedeo MODIGLIANI (1884-1920) | Nu couché (sur le côté gauche) (1917) | $157,159,000 | May 14, 2018 | Sotheby’s New York |

| 5 | Francis BACON (1909-1992) | Three Studies of Lucian Freud (1969) | $142,405,000 | Nov 12, 2013 | Christie’s New York |

| 6 | Alberto GIACOMETTI (1901-1966) | L’homme au doigt (1947) | $141,285,000 | May 11, 2015 | Christie’s New York |

| 7 | QI Baishi (1864-1957) | Screens of landscapes (1925) | $140,954,580 | Dec 17, 2017 | Poly Beijing |

| 8 | Edvard MUNCH (1863-1944) | The scream (1895) | $119,922,500 | May 2, 2012 | Sotheby’s New York |

| 9 | Pablo PICASSO (1881-1973) | Fillette à la corbeille fleurie (1905) | $115,000,000 | May 8, 2018 | Christie’s New York |

| 10 | Jean-Michel BASQUIAT (1960-1988) | Untitled (1982) | $110,487,500 | May 18, 2017 | Sotheby’s New York |

| 11 | Pablo PICASSO (1881-1973) | Nude, Green Leaves and Bust (1932) | $106,482,500 | May 4, 2010 | Christie’s New York |

| 12 | Andy WARHOL (1928-1987) | Silver Car Crash (Double Disaster) (1963) | $105,445,000 | Nov 13, 2013 | Sotheby’s New York |

| 13 | Pablo PICASSO (1881-1973) | Garçon à la pipe (1905) | $104,168,000 | May 5, 2004 | Sotheby’s New York |

| 14 | Alberto GIACOMETTI (1901-1966) | L’homme qui marche I (1960) | $103,689,994 | Feb 3, 2010 | Sotheby’s London |

| 15 | Alberto GIACOMETTI (1901-1966) | Chariot (1950) | $100,965,000 | Nov 4, 2014 | Sotheby’s New York |

| copyright ©2018 artprice.com | |||||

China reduces its unsold rate before a decisive 2nd half: the soft power battle with the US intensifies.

With a total turnover of $2 billion, China (Hong Kong and Taiwan included) remains in second position in the global ranking of the world’s major marketplaces. The best result was hammered by Poly in Hong Kong for a painting by the abstract painter Zao Wou-Ki, Et la terre était sans forme (1956-1957), which fetched $23.3 million. However, despite this record, China’s H1 2018 Fine Art auction turnover was down -7% versus H1 2017.

Fortunately, the restructuring of the Chinese art market has brought a number of benefits including a new and very strict legal framework designed to eliminate unpaid bids with an obligation of immediate payment for purchases of artworks. Such a law would delight Western auction houses.

Although the number of works put up for sale dropped by -35% in H1 2018, the contraction was offset by a lower unsold rate. The unsold rate fell back from 68% (in H1 2017) to 57% (H1 2018). Still more than half the lots offered in China fail to sell, a very high rate compared to Western unsold rates: 22% in the USA, 29% in the UK, 40% in France. The current reorganisation of the Chinese market could lead to a much more efficient structure over the coming years, with an unsold rate below 50% in China.

Soft Power rivalry with the United States for dominance of the Art Market will once again (as in 2016 and 2017) depend on results in the year’s second half. For example, Beijing’s most prestigious auctions are now organized in December. Four of China’s top five results in 2017 were hammered a few days before the end of the year. It is very possible that we will again see the Chinese market show its full power and determination to compete with the US for the leading position on the Global Art Market in 2018 in the last few days of the year.

Europe is modestly participating in the growth

The possibility of a “hard” Brexit has not managed to profoundly alter the structure of the European Art Market. Continental Europe ($920 million) is still far from competing with the firmly established triumvirate of the United States, China and the United Kingdom.

H1 2018 – Contribution of the European Union to the overall economic growth

| Turnover | Evolution | |

|---|---|---|

| USA | $3,341,746,766 | 48 % |

| China | $1,997,226,110 | -7 % |

| UK | $1,873,284,804 | 18 % |

| France | $372,461,596 | 8 % |

| Germany | $122,765,010 | 17 % |

| Italy | $118,907,954 | 22 % |

| Switzerland | $76,847,823 | 4 % |

| copyright ©2018 artprice.com | ||

Several European cities nevertheless retain a solid position on the global Art Market and are managing to develop alongside the major powers. In the shadows of London and New York, Paris, Milan, Vienna and Bern, among others, are successfully resisting the Anglo-Saxon and Asian pressure, defending an extremely dynamic Art Market, even if not particularly high-end.

The French capital turned over 25,000 Fine Art lots in the first half of 2018 alone. Thanks to Drouot, but also Artcurial, Tajan, Aguttes, Cornette de Saint Cyr and many other auctioneers, Paris is not entirely dependent on the performances of the giants Sotheby’s and Christie’s. The French capital is still the fifth largest secondary art market in the world and continues to nurture the hope of one day taking over London’s place in Europe.

Paris accounts for 87% of French Fine Art auction turnover, although we occasionally see excellent results in France’s Provinces. On 27 January 2018, Jack-Philippe Ruellan in Vannes (Brittany ) sold Raden Saleh’s Chasse au taureau sauvage (Banteng) (1855) – a canvas found in a private cellar – for over $11 million.

The German market, more evenly distributed across its major cities, posted a 17% turnover increase versus H1 2017. The auctioneers Kornfeld, Grisebach, Ketterer, Lempertz, Van Ham and Koller are all among the top 30 most efficient auction operators on the global Art Market.

Top 30 auctioneers by Fine Art turnover in H1 2018

| Auction house | Turnover | Sold lots | Highest price | |

|---|---|---|---|---|

| 1 | Christie’s | $3,032,226,760 | 7,682 | $115,000,000 |

| 2 | Sotheby’s | $2,223,739,467 | 7,065 | $157,159,000 |

| 3 | Phillips | $434,526,815 | 2,430 | $57,829,046 |

| 4 | Poly | $325,151,003 | 1,779 | $23,305,301 |

| 5 | China Guardian | $271,050,930 | 3,763 | $19,649,625 |

| 6 | Council | $226,335,666 | 1,238 | $16,076,966 |

| 7 | Bonhams | $84,699,221 | 3,436 | $2,915,332 |

| 8 | RomBon | $77,179,521 | 1,052 | $3,606,882 |

| 9 | Artcurial | $55 ,628,304 | 1,830 | $8,258,341 |

| 10 | Dorotheum | $37,810,854 | 2,738 | $651,399 |

| 11 | Galerie Kornfeld | $37,238,101 | 707 | $3,459,998 |

| 12 | Seoul Auction | $35,650,477 | 252 | $8,882,941 |

| 13 | Beijing Hanhai Art | $30,276,932 | 2,406 | $729,938 |

| 14 | Mainichi Auction Inc. | $29,615,086 | 4,528 | $2,204,077 |

| 15 | K-Auction | $26,179,562 | 393 | $2,304,522 |

| 16 | Grisebach | $25,539,656 | 707 | $6,449,754 |

| 17 | Ketterer Kunst | $24,328,975 | 614 | $971,503 |

| 18 | Sungari International | $23,654,731 | 246 | $1,777,107 |

| 19 | Shanghai DuoYunXuan | $20,834,687 | 1,608 | $3,094,923 |

| 20 | Lempertz | $19,893,340 | 713 | $1,069,474 |

| 21 | Beijing ChengXuan | $18,941,492 | 536 | $2,858,127 |

| 22 | Heritage Auctions | $17,743,468 | 2,416 | $762,500 |

| 23 | Asta Guru | $17,385,696 | 121 | $3,080,487 |

| 24 | Ravenel | $17,266,967 | 167 | $5,156,649 |

| 25 | Farsetti | $16,914,824 | 797 | $1,066,887 |

| 26 | iART | $16,595,405 | 216 | $10,116,533 |

| 27 | Bukowskis | $16,403,523 | 1,055 | $2,044,019 |

| 28 | Van Ham | $16,349,697 | 963 | $936,589 |

| 29 | Koller | $15,406,149 | 871 | $1,760,101 |

| 30 | Saffronart | $15,389,266 | 191 | $3,891,261 |

| copyright ©2018 artprice.com | ||||

The Italian Art market also posted a very good performance in the first half of 2018. With 14,650 lots generating a total of $118 million, up 22% on H1 2017. The presence of Sotheby’s and Christie’s in Milan allows Italy to maintain a high quality offer including important pieces by the country’s most sought-after 20th century artists like Piero Manzoni, Lucio Fontana, Salvatore Scarpitta and Alighiero Boetti.

Italy remains the world’s sixth largest art marketplace, but only accounts for 1.4% of the world’s auction turnover. Like Germany (1.5%), Switzerland (0.9%) and Austria (0.6%), Italy relies on a network of medium-sized auction houses (concentrated mainly in the northern part of the country). This network which includes Farsetti in Prato (800 lots sold), Il Ponte Casa D’Aste in Milan (1,300) and Meeting Art in Vercelli (2,000 lots), provides a dense and diversified market.

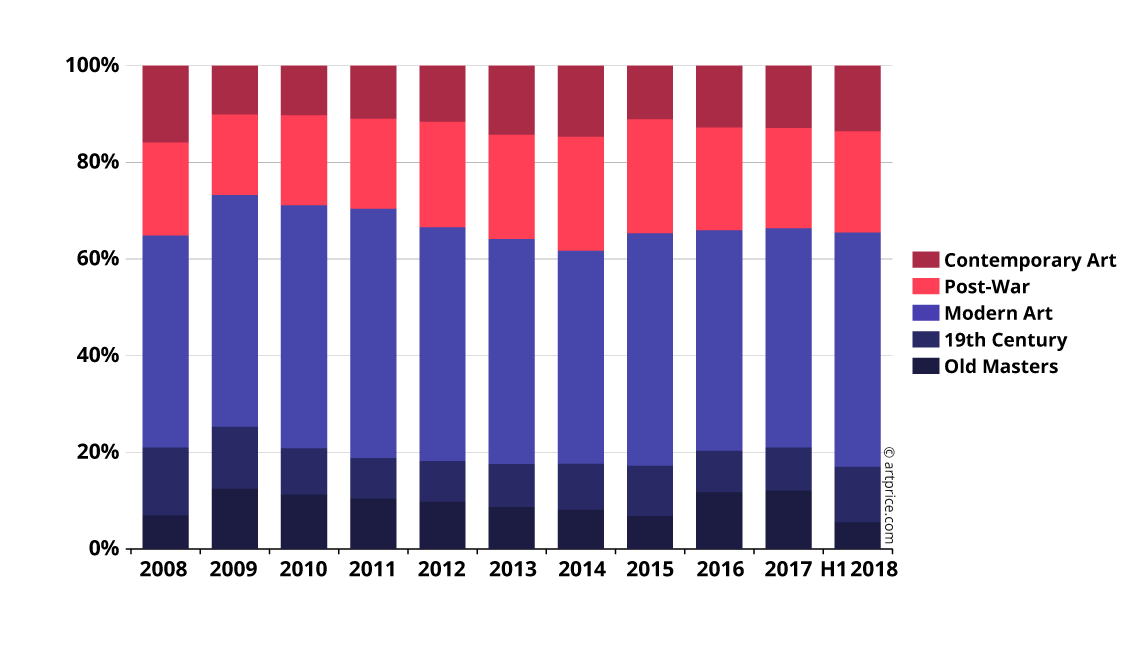

Domination of 20th Century Art

20th Century Art accounted for 80% of total global auction turnover from Fine Art in the first half of 2018. The works that attract the strongest media coverage and whose prices are rising fastest are undoubtedly those created after World War II. However, collectors are showing an insatiable appetite for works made between 1900 and 1940, a period that covers the last Impressionist masterpieces, but also, and above all, represents the apogee of Modern Art.

This period alone accounts for nearly half of global auction turnover from Fine Art and 40% of the lots sold. Modern artists were particularly prolific, thanks to a freer and more intuitive approach to artistic creation. Their importance in art history is continually being highlighted, and spectacular auction sales are frequent: among the ten most expensive works of H1 2018, eight were created between 1900 and 1940.

In line with this major market trend, Russian abstract art has suddenly come back into the limelight. On 15 May 2018 Kasimir Malevich’s Suprematist Composition (1916) fetched a stunning $85.8 million at Christie’s in New York. Acquired for $60 million in November 2008, the painting’s value increased 43% over the last ten years, representing an annual return on investment of 4.5%. With this new record, Malevich takes 9th place in Artprice’s latest ranking of artists by H1 2018 auction turnover, behind 3 other major figures of Modern painting: Picasso (1st), Modigliani (5th) and Matisse (7th).

Claude Monet is, once again, the only 19th century artist among the top 10 best Fine Art auction results in H1 2018. In 4th place, his Nymphéas en fleur was actually painted during WWI (c.1914-1917). Meanwhile, the results for two 19th century paintings (Vincent Van Gogh’s Vue de l’asile et de la Chapelle St-Paul de Mausole (1889) and Paul Gauguin’s small oil-on-canvas The Wave (1888)), which fetched $39.6 million and $35.2 million respectively, show that 19th century masterpieces are becoming so rare that prices rise quickly for good quality works, even when not necessarily considered their best works.

Old Masters kept a relatively low profile during H1 2018: the best result, at $18.7 million, was hammered at Sotheby’s Hong Kong on 3 April 2018 for River Qingxi in Mists by Qian Wencheng (1720-1772), and that was only the 46th best result of the semester…

Distribution of sales revenue by creation period

Nineteenth Century art and Old Masters now represent substantially smaller segments of the market than Post-War and Contemporary Art. The latter periods are now bigger in both transaction numbers and turnover. Works created during the second half of the 20th century and the 21st century exist in far greater numbers… but demand for them is even stronger. Our ranking of artists by H1 2018 auction turnover has Andy Warhol in 3rd place, Gerhard Richter at 11th and David Hockney at 12th! Jean-Michel Basquiat’s Flexible (1984) fetched $45 million on 17 May 2018 at Phillips in New York, while a version of Jeff Koons’ monumental sculpture Play-Doh (1994-2014) sold for $22.8 million the same day at Christie’s.

The best performing Chinese artist during H1 2018 was Zao Wou-Ki (1921-2013). Works by the Expressionist painter are mainly sold in Hong Kong (74%) and France (14%), with the latter hosting an impressive retrospective at the Museum of Modern Art of the City of Paris (1 June 2018 – 6 January 2019). Apart from large-format canvases, his market also consists of numerous small works: in H1 2018, 25 of his drawings and 193 of his prints were auctioned for average prices of $75,000 and $4,200 respectively.

The best result for a female artist in H1 2018 was hammered for a work by the American Expressionist, Joan Mitchell. On 17 May 2018, her Blueberry (1969) demolished Christie’s estimate ($5 – 7 million) setting a new auction record of $16.6 million. In early May, the David Zwirner Gallery announced it had signed an exclusive representation deal with the Joan Mitchell Foundation. A first solo exhibition of the artist’s works is scheduled in New York in 2019… but the market’s reaction to the announcement was immediate. Joan Mitchell’s price index has risen +24% since January 2018. Over the last fifteen years, the value of her paintings has rocketed: $100 invested in 2003 is worth an average of $1,000 today.

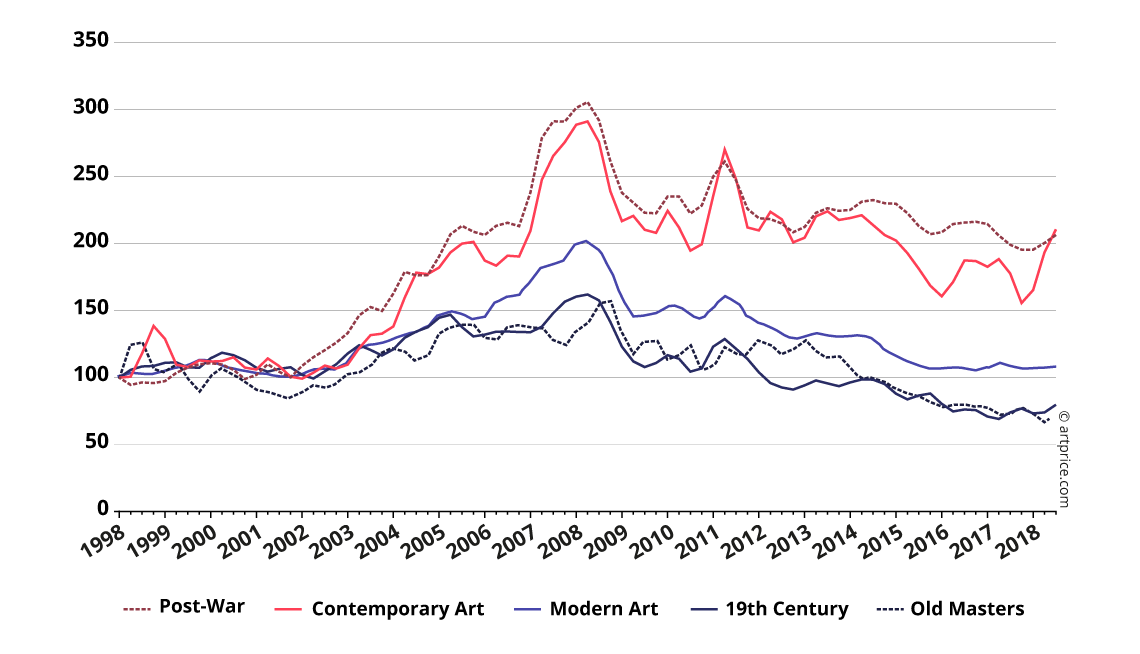

Investing in Art

Post-War Art and Contemporary Art are today the two segments that show the strongest prices increases over the short, medium and longer terms. These two periods of creation enjoy exponential demand which the supply is able to follow. In contrast, the other periods of creation are suffering from a gradual dilution of prices: as the major top-quality works become increasingly rare, the overall quality of the works available inevitably tends to diminish.

Artprice Indices by creation period – January 2000, base 100

Meanwhile, Artprice’s overall index for Contemporary Art shows a remarkable progression of +27% for the first half of 2018. This performance is driven by the extremely rapid price evolutions enjoyed by a number of artists active today, including the Americans Kerry James Marshall, Mark Bradford and George Condo. The latter’s work is now appearing in auction sales and fetching very impressive results. On 17 May 2017, Christie’s New York presented Condo’s Nude and Forms (2014) for its first ever auction appearance; the work fetched over $6 million.

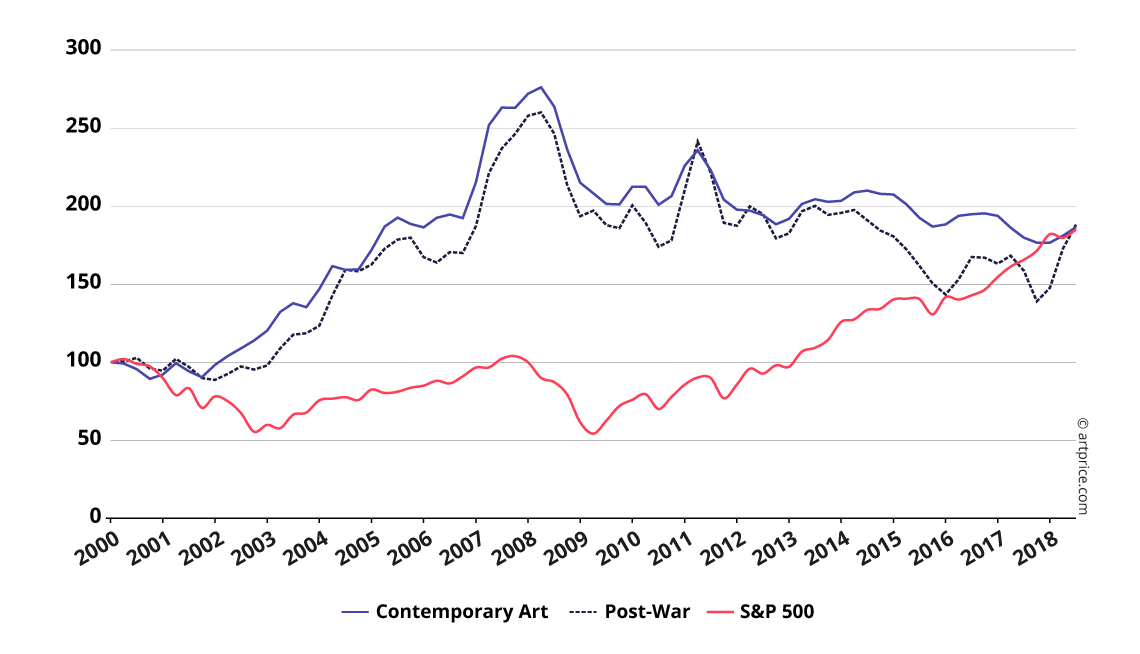

In the longer term, Contemporary Art and Post-War Art are honourable rivals of financial markets. Since 2000, the indices of these two periods have posted an overall gain equal to that of the S&P 500.

Artprice Indices vs S&P 500 – January 2000, base100

30.6

30.6