Stronger Demand for Contemporary Art

Editorial

With the collaboration of its Chinese State partner AMMA (Art Market Monitor of Artron), Artprice has identified 262,300 Fine Art lots (+0.1%) sold via public auctions around the world in the first half of 2019. Together these transactions generated a total of $6.98 billion, down 17.4% versus H1 2018.

However, Artprice’s price index calculation, based on our ‘repeat sales method’, shows a 5% increase in art prices. Against the backdrop of a banking sector operating in a negative or near-zero interest rate environment, art has become an excellent investment and this will no doubt add momentum to the expansion of the Art Market.

“We are seeing a tightening of the balance between supply and demand in the Art Market,” explains thierry Ehrmann, Artprice’s Founder/CEO.

“The results show persistent demand for museum-quality works, but the secondary market’s supply has tightened somewhat. The Art Market – as we have known it since 1975 – appears to be reaching its structural limits: auction houses are struggling to maintain their operating margins and also to convince collectors to sell their best pieces. They are constantly increasing their buyer fees while simultaneously inventing new ways of reassuring sellers. Guarantees can encourage some sales, but this mechanism doesn’t represent a global solution. It’s time for the Art Market to start a new digital era”.

The recent acquisition of Sotheby’s and Artprice.com’s metamorphosis into Artmarket.com (its new company name submitted to the Extraordinary General Meeting) are two changes that clearly reflect the Art Market’s entry into the age of the Internet.

Key figures

| H1 2019 | H1 2018 | Change (%) | ||||

|---|---|---|---|---|---|---|

| Turnover | $6,980,144,500 | $8,445,850,000 | -17.4% | |||

| Best result | $110,747,000 | $157,159,000 | -29.5% | |||

| Average price | $26,600 | $32,200 | -17.4% | |||

| Median price | $970 | $1,030 | -5.8% | |||

| Sales sessions | 3,500 | 3,800 | -7.9% | |||

| Sold lots | 262,300 | 262,100 | 0.1% | |||

| Unsold rate | 40% | 39% | 1.6% | |||

| © AMMA & Artprice.com | ||||||

- Turnover in the USA (-20%), China (-12%) and the UK (-25%) has contracted

- The number of lots sold between $10 and 100 million dropped by 41%

- Top quality Modern (-21%) and Old Master (-38%) works in short supply

- Claude Monet dominated the H1 2019 with 23 works sold for €251 million

- Contemporary Art prices posted an increase of +40%

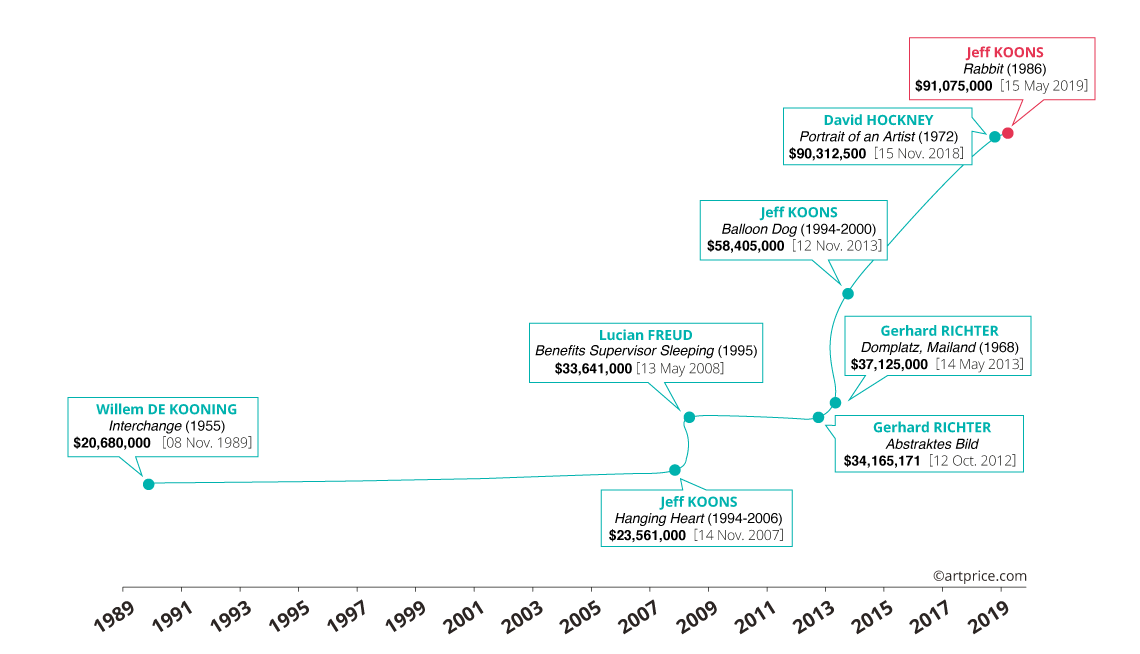

- New record for a living artist: Jeff Koons’ Rabbit (1986) fetched $91 million

- Average annual return works out at +4.6% on an average holding of 13 years

- The Artprice100© index posts a growth of +16% in H1 2019

Wassily Kandinsky – Vertiefte Regung (1928)

$5,682,500 – on 5 May 2010, Sotheby’s New York

$6,410,000 – on 5 November 2015, Sotheby’s New York

$8,072,000 – on 28 February 2019, Sotheby’s London

Supply contracts… and boosts prices

The art market’s figures for the first half of 2019 reveal a paradox: sales volumes fell 17.4% while the overall price index rose 5%. In other words, the prices of artworks rose while the market contracted. However, the lower sales revenue was not attributable to a fall in the number of transactions, which remained almost perfectly stable; the contraction in turnover therefore essentially reflected the type and quality of the works offered during the semester.

The first half of 2018 received a major boost from the Rockefeller collection sales, the evening session of which generated $646 million from just 44 lots sold. By comparison, the most profitable sale during H1 of this year (in turnover terms) was Christie’s Contemporary & Postwar Art session of 15 May 2019 in New York which generated $538 million from 58 lots sold.

Throughout the first half of 2019, we have seen a relative dearth of Modern Art masterpieces which normally make up the heart of the high-end market.

Encouraged by a strong economic situation along with negative or close-to-zero refinancing rates, the demand for artworks has continued to grow, while the supply has contracted. Some collectors are clearly reluctant to sell works they believe are bound to increase in value in the coming years; especially as transaction costs remain particularly high, via both auction sales and galleries.

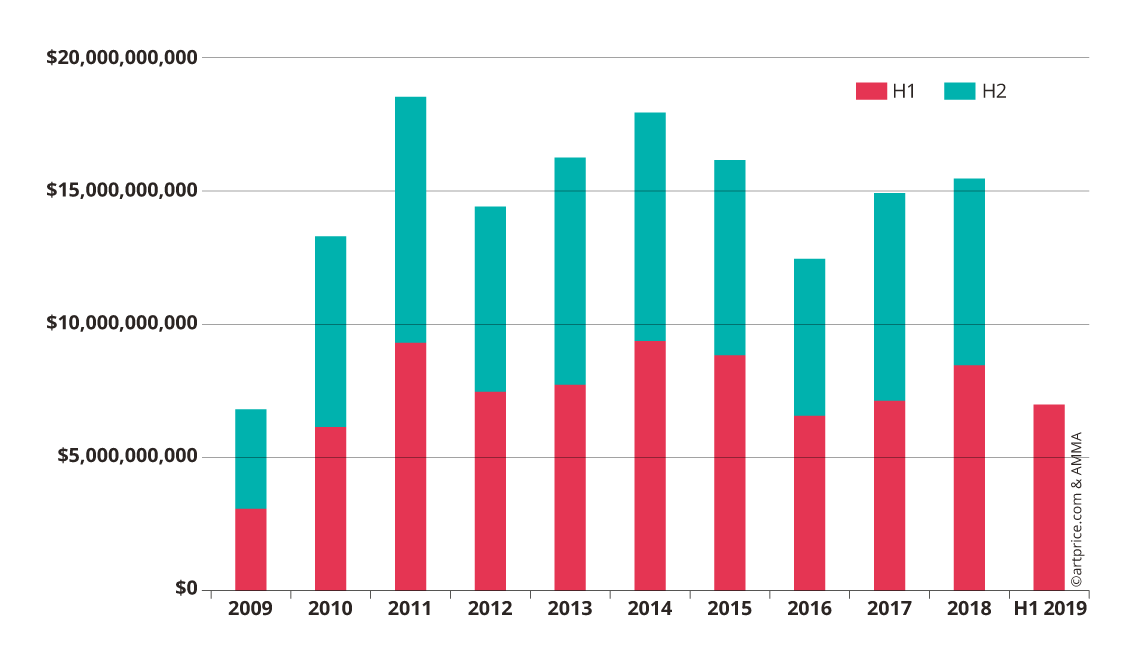

Global auction turnover since 2009

Works capable of fetching above $100 million are nowadays an essential part of the art market, but, being so rare, their annual or semi-annual contribution is somewhat fragile. In H1 2018, two works exceeded this threshold: Pablo Picasso’s Fillette à la corbeille fleurie (1905) and Nu couché (sur le côté gauche) (1917). The first was part of the legendary Rockefeller Collection, the dispersion of which was dubbed the “Sale of the Century”. The second was sold to a single bid.

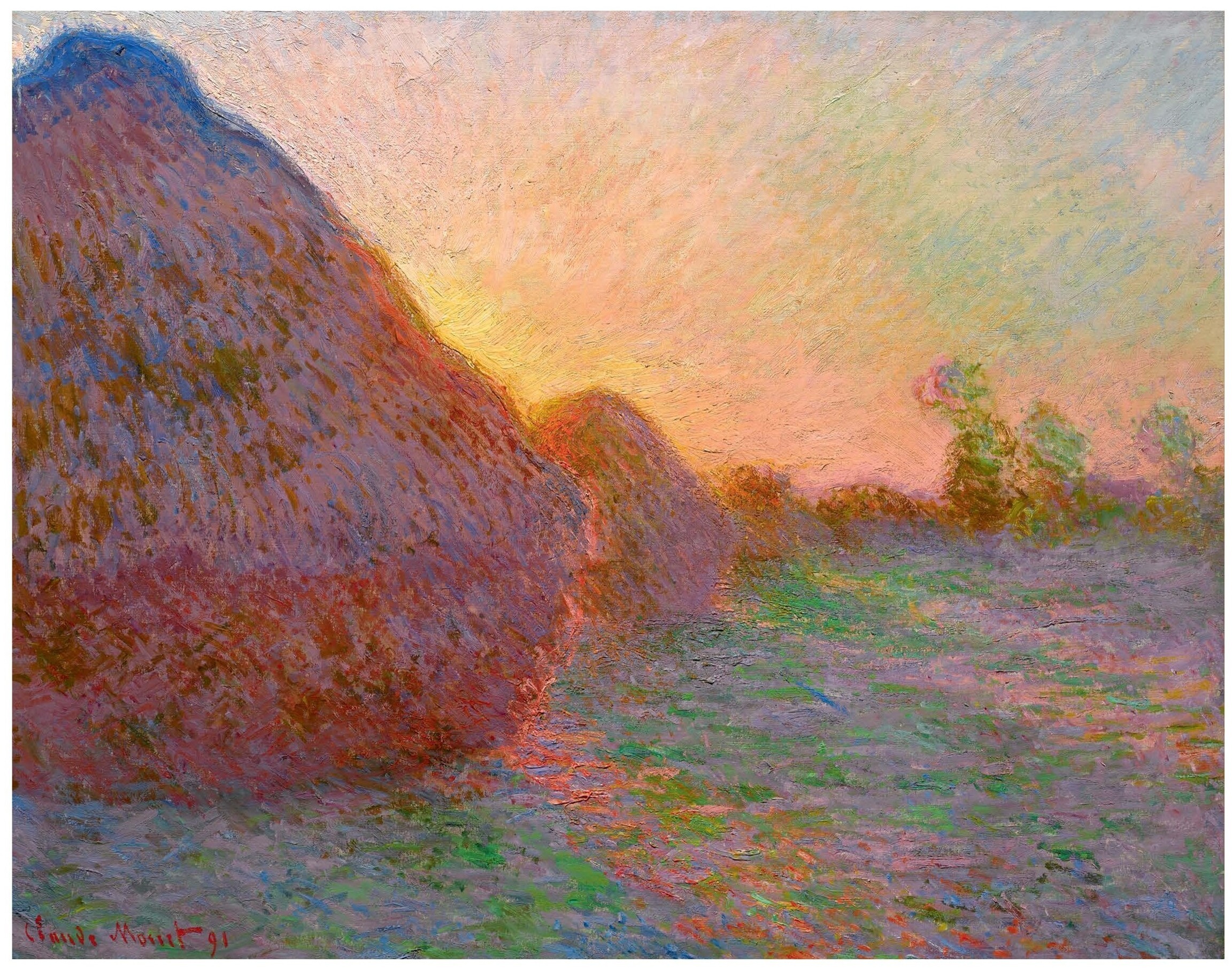

In H1 2019, the only artwork to reach the $100 million threshold was Claude Monet’s Meules (1890)… and that new record was more-or-less expected given the steady progression of Claude Monet’s prices. Nonetheless, in a long-term perspective, the value accretion of Meules (1890) is remarkable. The work has posted an average annual yield of +12% since its was last sold publicly in 1986, at Christie’s in New York, rising from $2.5 million thirty-three years ago to $110.7 million this year.

The private sale – two days before its scheduled auction in Toulouse – of the Judith and Holofernes attributed to Caravaggio and estimated between $100 and $150 million, illustrates the fragility of the high-end art market. In statistical terms, the withdrawal of such an exceptional lot (13 days after bidder registration was formally closed) has left the French market with a much lower first half total.

Number of lots sold per price range

| H1 2019 | H1 2018 | Change (%) | |||

| ≥ $100 million | 1 | 2 | -50% | ||

| $10 – 100 million | 63 | 106 | -41% | ||

| $5 – 10 million | 100 | 122 | -18% | ||

| $1 – 5 million | 683 | 786 | -13% | ||

| $500,000 – 1 million | 778 | 883 | -12% | ||

| $100,000 – 500,000 | 4,896 | 5,369 | -9% | ||

| $50,000 – 100,000 | 4,909 | 5,443 | -10% | ||

| $5,000 – 50,000 | 44,203 | 47,609 | -7% | ||

| © Artprice.com |

|||||

The major auction houses are increasingly looking for ways to entice vendors, and this usually involves offering some form of price guarantee. But these arrangements expose them to greater risks and end up reducing their operating margins. Moreover, the guarantees actually distort the natural balance between supply and demand.

At Art Basel 2019, Bloomberg reporter, Katya Kazakina, noted that Peter Doig’s “The Architect’s Home In the Ravine” was being offered at the Gagosian for $25 million. As Artprice observed in its latest 2018 Contemporary Art Market Report, the work has been auctioned no less than five times in less than 20 years, including twice in the past three years, pushing Doig’s prices up at an impressive pace:

- $474,800 – 26 June 2002, Sotheby’s London

- $3,624,000 – 15 May 2007, Sotheby’s New York

- $11,975,900 – 13 February 2013, Christie’s London

- $16,346,100 – 11 February 2016, Christie’s London

- $19,958,600 – 7 March 2018, Sotheby’s London

According to Bloomberg, investor Abdallah Chatila placed an irrevocable bid at the last sale of this canvas at Sotheby’s in exchange for a $1 million fee. As his bid was the only bid, he ended up owning a painting he was not particularly keen on keeping. So, a year later The Architect’s Home in the Ravine was put on sale again at Art Basel … and its value continues to climb.

This anecdote illustrates the importance for the entire Art Market of works priced above the one-million-dollars threshold at auction. They represent recognition for artists, galleries and collectors, as well as very lucrative transactions for auction houses. However, the number of lots sold in this price range suffered a very sharp contraction in the first six months of 2019.

Claude Monet – Meules (1890)

$110,747,000 – 14 May 2019, Sotheby’s New York

$2,530,000 – 14 May 1986, Christie’s New York

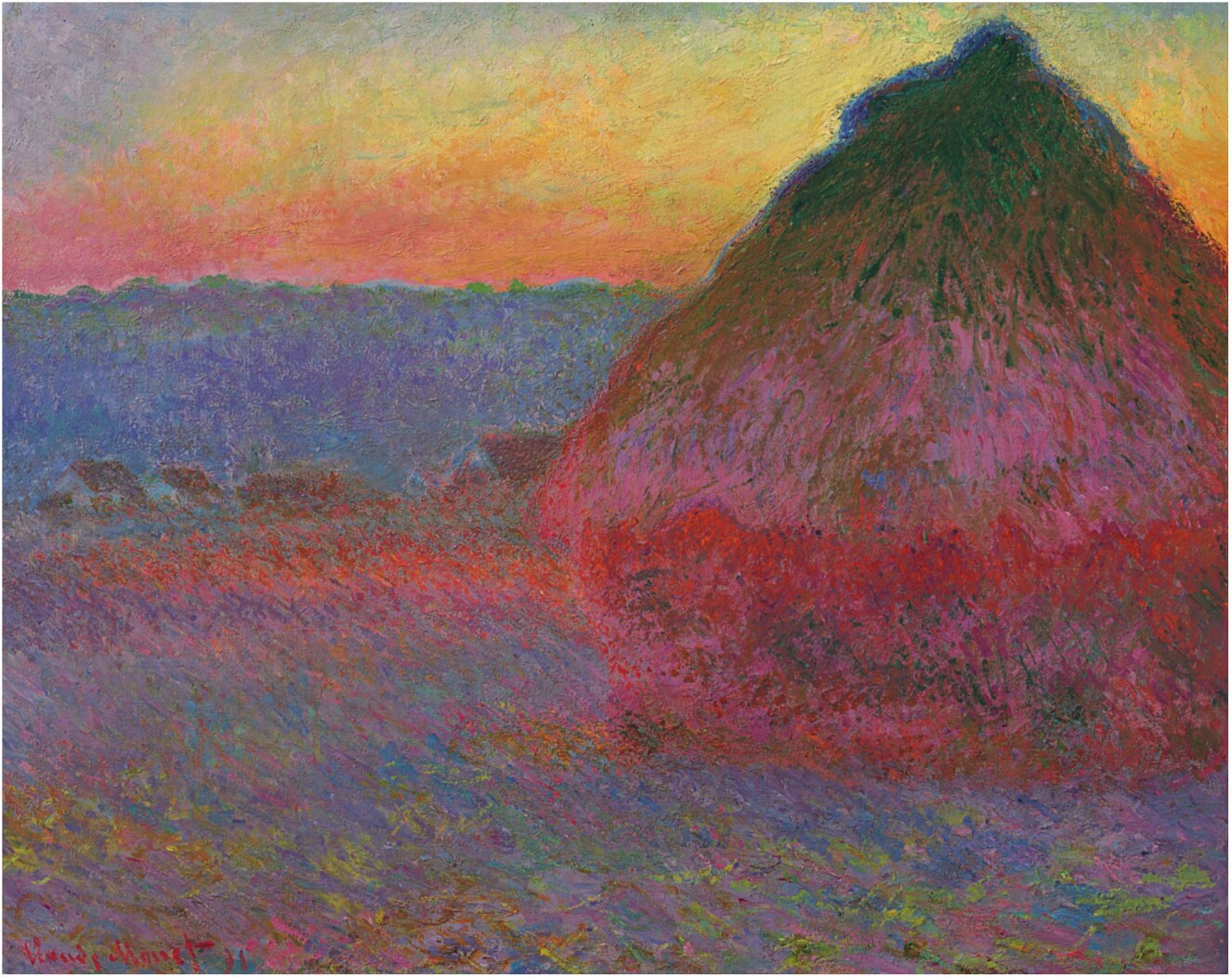

Claude Monet – Meule (1891)

$81,447,500 – 16 November 2016, Christie’s New York

$11,992,500 – 11 May 1999, Sotheby’s New York

The New “Classics” of Contemporary Art

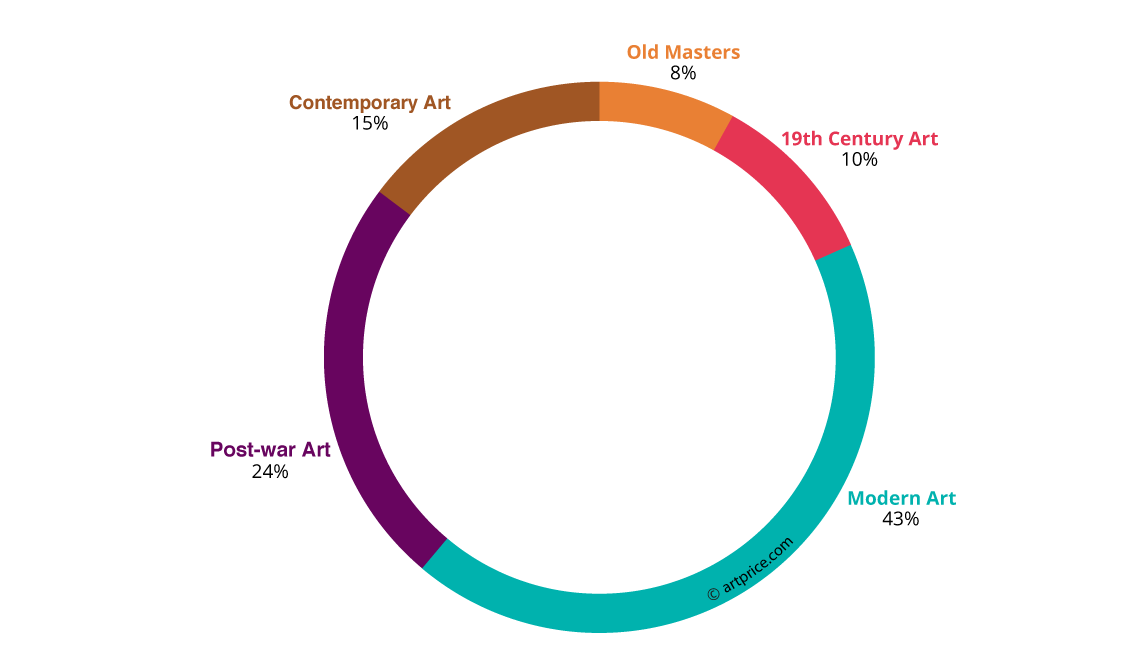

So far this year Modern art – which has driven the high-end art market over the last twenty years – has played a relatively diminished role in the market and, at the half-way point, is posting a -22% turnover contraction. There were no major works by Pablo Picasso, Amedeo Modigliani or Alberto Giacometti on offer, each of whom has several results above the $100 million threshold (including buyer fees) to his name (accounting for 9 of the 16 hammered for works of Fine Art). Nevertheless, Modern Art remained the biggest segment of the art market in H1 2019.

Global Fine Art auction turnover by period of creation

In the absence of Modern masterpieces, demand turned to other signatures, other movements and other creative periods. In the early part of the year we saw particular interest in London for several major 19th century signatures.

Nevertheless, the first half of 2019 was clearly dominated by Claude Monet. The year started badly when his Saule pleureur et bassin aux nymphéas (Weeping Willow and Water Lily Pond) (1916-19) failed to sell at Christie’s on 27 February in London against an estimate of $60 million. But as things turned out, this failure contributed to the balance between supply and demand, since of the 27 other Monet works offered in H1 2019, more than 85% found buyers, generating a total of $251 million and making Claude Monet the world’s best performing artist in H1 2019, ahead of Pablo Picasso and Zao Wou-Ki.

Even more surprising was a series of new auction records for Post-Impressionist artists, including Paul Signac, Gustave Caillebotte, Pierre Bonnard, proving that the best canvases of this period are still very much in demand. For his part, Paul Cézanne’s auction performance was the best for 20 years, with his second best-ever result at $59.3 million. The value of Bouilloire et fruits (c.1888-90) doubled since its last appearance in 1999.

Top 10 artists’ auction records hammered in H1 2019

| Artist | Work | Price | Sale | |

|---|---|---|---|---|

| 1 | Claude MONET (1840-1926) | Meules (1890) | $110,747,000 | 14 May, Sotheby’s New York |

| 2 | Jeff KOONS (1955) | Rabbit (1986) | $91,075,000 | 15 May, Christie’s New York |

| 3 | Robert RAUSCHENBERG (1925-2008) | Buffalo II (1964) | $88,805,000 | 15 May, Christie’s New York |

| 4 | Louise BOURGEOIS (1911-2010) | Spider (1997) | $32,055,000 | 15 May, Christie’s New York |

| 5 | Frank STELLA (1936) | Point of Pines (1959) | $28,082,500 | 15 May, Christie’s New York |

| 6 | Paul SIGNAC (1863-1935) | Le Port au soleil couchant (1892) | $25,934,244 | 27 Feb., Christie’s London |

| 7 | Gustave CAILLEBOTTE (1848-1894) | Chemin montant (1881) | $22,160,721 | 27 Feb., Christie’s London |

| 8 | Pierre BONNARD (1867-1947) | Une terrasse à Grasse (1912) | $19,570,000 | 13 May, Christie’s New York |

| 9 | BALTHUS (1908-2001) | Thérèse sur une banquette (1939) | $19,002,500 | 13 May, Christie’s New York |

| 10 | KAWS (1974) | The Kaws Album (2005) | $14,772,677 | 1 Apr., Sotheby’s Hong Kong |

| © Artprice.com | ||||

Moreover, the market seems to have elected some new “classics” among exceptional works produced by Post-War and Contemporary artists.

Jeff Koons’ Rabbit (1986) was probably the most striking example of how the major auctioneers (in this case Christie’s) succeed in elevating certain artworks, made in the second half of the 20th century, to the status of veritable masterpieces. This 1-meter high stainless steel sculpture (from an edition of 3 plus an artist’s proof) is the last one still in circulation. Number 2 of the 3 produced, it was exhibited by Christie’s in an immaculate white room and presented as “a chance to own the controversy”. Shortly after, it became the world’s most expensive work by a living artist, having fetched the 20th best result ever recorded for a work of fine art in auction history.

Evolution of the record auction price for a living artist

In the absence of major works by Jean-Michel Basquiat, Andy Warhol or Jackson Pollock in H1 2019, the American market turned its attention to a handful of other major signatures in its Art History… starting with Robert RAUSCHENBERG. Following his death in 2008 and his MoMA retrospective in 2017, the US market was eagerly awaiting a major work. The 243.8 x 183.8 cm oil-and-silkscreen-on-canvas, Buffalo II (1964) appears to capture the political and social zeitgeist of America’s Kennedy years and it largely exceeded the estimates at Christie’s on 15 May 2019, fetching $88.8 million.

A new record was also hammered for the painter and poet Marsden HARTLEY, whose influence on American painting is undeniable. His painting Abstraction (1912/13) – auctioned for the third time in 30 years – has shown a steady value increase and is now clearly considered a ‘safe investment’ in the US art market:

- $ 1,155,000 – 3 December 1992, Sotheby’s New York

- $ 2,205,750 – 30 November, 2000, Sotheby’s New York

- $ 6,744,500 – 22 May 2019, Christie’s New York

Still in the United States… a giant Spider (1997) by Louise Bourgeois sold for $32 million, generating art history’s second best-ever auction result for a female artist behind Georgia O’Keeffe’s Jimson Weed/White Flower No. 1 (1932) which fetched $44.4 million in November 2014.

The market for American abstraction continued to open up for the country’s female artists after the records in May 2018 for Joan Mitchell ($16.6 million) and Helen Frankenthaler ($3 million). This year, the market pursued its recognition of Lee KRASNER (Jackson Pollock’s partner) hammering a record of $11.7 million on 16 May at Sotheby’s New York for her painting The Eye Is the First Circle.

Top 10 Auction Records for Women Artists in H1 2019

| Artist | Work | Price | Sale | |

|---|---|---|---|---|

| 1 | Louise BOURGEOIS (1911-2010) | Spider (1997) | $32,055,000 | 15 May, Christie’s New York |

| 2 | Lee KRASNER (1908-1984) | The Eye Is the First Circle | $11,654,000 | 16 May, Sotheby’s New York |

| 3 | Yayoi KUSAMA (1929) | Interminable Net #4 (1959) | $7,953,200 | 01 Apr., Sotheby’s Hong Kong |

| 4 | Elisabeth VIGÉE-LEBRUN (1755-1842) | Muhammad Dervish Khan (1788) | $7,185,900 | 30 Jan., Sotheby’s New York |

| 5 | Julie MEHRETU (1970) | Black Ground (Deep Light) (2006) | $5,631,700 | 1 Apr., Sotheby’s Hong Kong |

| 6 | Carmen HERRERA (1915) | Blanco Y Verde (1966/67) | $2,900,000 | 1 March, Sotheby’s New York |

| 7 | MI Qiaoming (1986) | Buddha In The Dream (2018) | $1,773,500 | 15 June, Hanhai Beijing |

| 8 | Monir FARMANFARMAIAN (1924-2019) | Untitled (2018) | $1,082,900 | 11 Jan., Auction Tehran |

| 9 | Angelica KAUFFMAN (1741-1807) | Portrait of Three Children | $915,000 | 30 Jan., Sotheby’s New York |

| 10 | LALAN (1921-1995) | La lune est voilée (1974) | $863,000 | 31 March, Sotheby’s Hong Kong |

| © Artprice.com | ||||

The auction records for women artists this year reveal a greater level of diversity than those for men, with half being hammered for non-European/American artists. Julie Mehretu, who today lives and works in New York, but was born in Addis Ababa, Ethiopia. Although her work has never been shown in Asia, she generated a superb new record in Hong Kong, a few months ahead of her first major retrospective, scheduled for summer 2020 at the Whitney Museum in New York.

Leng Jun – View of the world No.3 (世纪风景之三 ) (1995)

© Leng Jun

$6,330,000 – 3 June 2019, China Guardian Beijing

$4,054,000 – 22 December 2016, Poly Shanghai

Soft Power: the contraction benefits Hong Kong

In H1 2019, secondary market Fine Art turnover shrank in nearly all of the world’s major marketplaces. Germany posted a stable figure… but it accounts for just 2% of global turnover. China, the United States, England, France and Italy are all facing roughly the same challenge: how to maintain the intensity of transactions in the high-end market.

Sotheby’s and Christie’s, which are present in each of these countries, have not yet decided to concentrate their best lots on their key markets… but that might become necessary. In the West, that would lead to an even greater domination of the market by New York and London, which could, in turn, be detrimental to Paris and Milan. Their London based Italian sales have already ‘transferred’ a significant share of the Italian market to England. In this context, the outcome of the Brexit deadlock is bound to have an impact.

Geographical distribution of Fine Art auctions

| H1 2019 | H1 2018 | Change (%) | ||||

|---|---|---|---|---|---|---|

| 1 | United States | $2,677,835,000 | $3,346,268,000 | -20% | ||

| 2 | China | $1,762,875,000 | $1,997,226,000 | -12% | ||

| 3 | United Kingdom | $1,408,229,000 | $1,866,638,000 | -25% | ||

| 4 | France | $329,649,000 | $376,738,000 | -12% | ||

| 5 | Germany | $131,567,000 | $128,470,000 | 2% | ||

| 6 | Italy | $108,473,000 | $121,590,000 | -11% | ||

| 7 | Switzerland | $70,280,000 | $76,974,000 | -9% | ||

| 8 | Japan | $52,772,000 | $68,668,000 | -23% | ||

| 9 | Austria | $49,983,000 | $54,216,000 | -8% | ||

| 10 | Australia | $32,264,000 | $33,563,000 | -4% | ||

| 11 | India | $29,845,000 | $38,352,000 | -22% | ||

| 12 | South Korea | $29,842,000 | $35,838,000 | -17% | ||

| 13 | Belgium | $29,820,000 | $38,757,000 | -23% | ||

| 14 | Czech Republic | $29,145,000 | $23,527,000 | 24% | ||

| 15 | Sweden | $28,072,000 | $24,515,000 | 15% | ||

| © AMMA & Artprice.com | ||||||

Posting a 4% increase in turnover versus the same year-earlier period, the Hong Kong marketplace actually grew while all its global competitors contracted. Generating an auction total of $700 million in H1 2019, Hong Kong was looking stronger than ever… at least until the political tensions that erupted again in June. It is now Asia’s leading art market hub, accounting for up to 40% of the Chinese art market. Its growth has essentially been driven by Contemporary Art sales which posted a 56% increase in turnover, taking the city a good step further towards competing directly with London and New York… even with respect to new stars in the Western art market.

Geographical distribution of the turnover for the top 20 artists in H1 2019

| Artist | Turnover | New York | London | Beijing | Hong Kong | |

|---|---|---|---|---|---|---|

| 1 | Claude MONET (1840-1926) | $251,165,100 | 67 % | 31 % | 0 % | 1 % |

| 2 | Pablo PICASSO (1881-1973) | $243,085,600 | 65 % | 31 % | 0 % | 0 % |

| 3 | ZAO Wou-Ki (1921-2013) | $155,827,800 | 0.1% | 0 % | 7 % | 76 % |

| 4 | Andy WARHOL (1928-1987) | $148,977,700 | 85 % | 8 % | 0 % | 1 % |

| 5 | ZHANG Daqian (1899-1983) | $110,686,700 | 1 % | 3 % | 42 % | 53 % |

| 6 | Jeff KOONS (1955) | $103,501,700 | 93 % | 6 % | 0 % | 0.1% |

| 7 | Paul CÉZANNE (1839-1906) | $98,418,200 | 71 % | 29 % | 0 % | 0 % |

| 8 | WU Guanzhong (1919-2010) | $95,895,200 | 1 % | 0 % | 47 % | 52 % |

| 9 | Francis BACON (1909-1992) | $93,626,300 | 69 % | 30 % | 0 % | 0 % |

| 10 | Robert RAUSCHENBERG (1925-2008) | $90,964,400 | 99 % | 0 % | 0 % | 0 % |

| 11 | David HOCKNEY (1937) | $88,956,700 | 26 % | 72 % | 0 % | 0 % |

| 12 | Roy LICHTENSTEIN (1923-1997) | $85,324,300 | 69 % | 26 % | 0 % | 4 % |

| 13 | Amedeo MODIGLIANI (1884-1920) | $85,051,900 | 71 % | 28 % | 0.1% | 0 % |

| 14 | Mark ROTHKO (1903-1970) | $79,994,500 | 100 % | 0 % | 0 % | 0 % |

| 15 | René MAGRITTE (1898-1967) | $76,110,700 | 4 % | 84 % | 0 % | 9 % |

| 16 | KAWS (1974) | $70,047,900 | 30 % | 11 % | 0 % | 54 % |

| 17 | Jean-Michel BASQUIAT (1960-1988) | $65,796,000 | 42 % | 57 % | 0 % | 0.2% |

| 18 | Gerhard RICHTER (1932) | $63,301,200 | 24 % | 67 % | 0 % | 5 % |

| 19 | Yayoi KUSAMA (1929) | $60,714,600 | 18 % | 3 % | 5 % | 50 % |

| 20 | Marc CHAGALL (1887-1985) | $56,071,000 | 46 % | 37 % | 0,2% | 0 % |

| © Artprice.com | ||||||

This was the case on 1 April for the American street artist Kaws, whose painting The Kaws album (2005) generated a truly spectacular result at Sotheby’s Hong Kong by fetching $14.8 million, no less than 15 times its high estimate. Kaws prices have been growing exponentially over the last two years, especially since his market has attracted collectors from New York, London and Hong Kong.

The English sculptor Tony Cragg also reached a new and quite unexpected auction record in Hong Kong. His stainless steel piece Untitled (2008) fetched close to $1 million on 27 May 2019 at Holly International. Founded in 1994 in Guangzhou, the Chinese auction house organized its first sales in Hong Kong in H1 2019. It joins the prestigious Chinese operators, Poly and China Guardian, as well as the Korean company, Seoul Auction. The latter hammered its best result of the first half in Hong Kong at $7.2 million for Le chant des sirènes (1953) by the Belgian Surrealist René MAGRITTE.

At the same time, Hong Kong manages to attract the best of Chinese artistic creation. Zao Wou-Ki generated the best H1 result for the entire Asian continent in Hong Kong; 53% of Zhang Daqian’s turnover was hammered there, and lots of new new Contemporary Chinese painters have received market exposure in the city. On 1 April 2019, we saw a new auction record for HAO Liang (1983) at Sotheby’s in Hong Kong when his ink-on-silk paper entitled An Anecdote from the Grove (2011) was hammered down for $1.9 million.

Lastly, the strength of the Hong Kong marketplace has much to do with its domination of a vast international geographic region which allows it to capture the best works from the whole of Asia. H1 2019 was notable for the $6.8 million sale of Untitled (1971) by the Korean abstract painter Whan-Ki KIM on 26 May 2019 at Seoul Auction. Hong Kong also recorded significant new records for the ultra popular Japanese artist Yayoi KUSAMA, Yoshitomo NARA and the young Ayako ROKKAKU at respectively $8 million, $4.4 million and $151,300.

Hong Kong now plays an essential role in Asia’s art market offering not just the best of Chinese art, but also the best works from the rest of Asia. And it is now also a gateway to China for the Western art market.

This was perfectly illustrated in H1 2019 by the latest auction record price for a work by the German artist Anselm Kiefer, hammered – astonishingly – in Beijing at a sale that was mediated via Hong Kong. His painting The fertile crescent (2009) reached $4 million in the Chinese capital on 3 June 2019. The sale catalogue stipulated that the work could not be brought into mainland China without incurring customs duties of approximately 25%. The lot was therefore to be collected in Hong Kong.

Collective Work / thierry Ehrmann, The Abode of Chaos – Anselm Kiefer (2019)

Art’s financial performance attracts investors

Based on 1,850 works previously acquired at auction and subsequently resold by the same channel during the first half of 2019, Artprice has calculated an annual yield of +4.6% for an average holding period of 13 years. Of the total number of works, 51% posted a price increase and 48% dropped in value (1% remained stable).

Meanwhile, the Artprice100© index rose +16% in the first half of 2019. A virtual portfolio consisting of the top 100 performers on the global auction market between 2014 and 2018, weighted for the relative magnitude of their turnover totals, this index outperformed the entire market notably thanks to exceptional results for Fu Baoshi and Wu Guanzhong in China, and for Robert Rauschenberg, Frank Stella and Martin Kippenberger in the West.

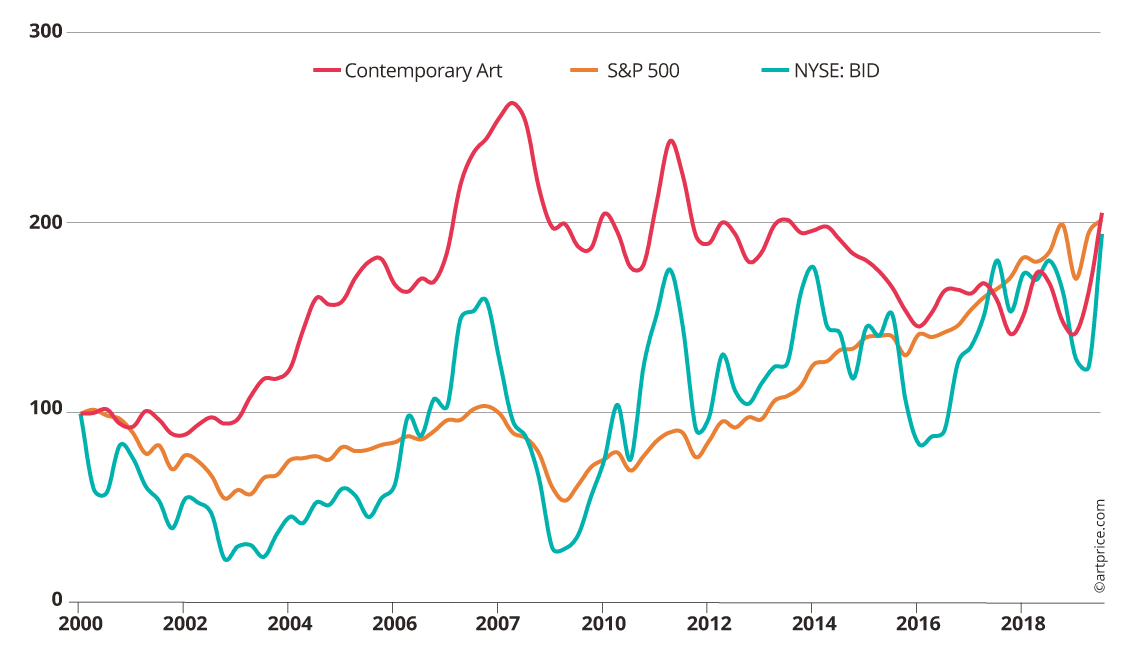

Our Contemporary Art price index climbed an impressive 40%. The auction performances of Jeff Koons, Peter Doig and Keith Haring gave the Contemporary segment the strongest growth of all segments in H1 2019. Over the long term, the financial performance of Contemporary Art is on a par with that of the US stock market… and Sotheby’s share price.

Artprice’s Contemporary Art Price Index vs. financial markets

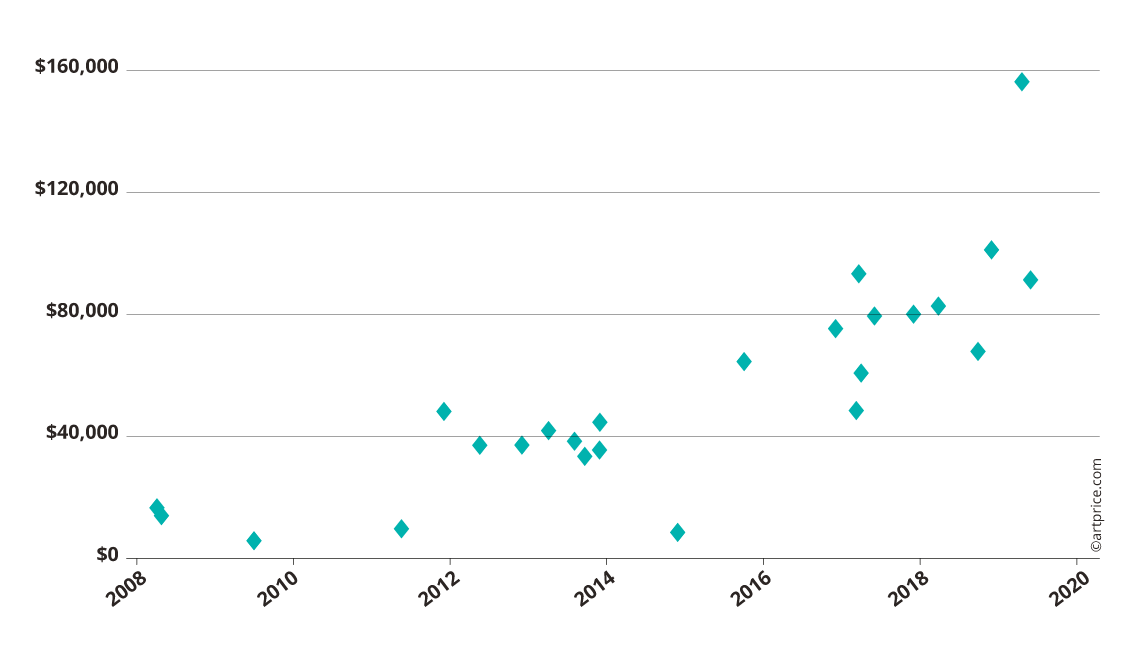

The most spectacular single-piece value increase in H1 2019 rewarded a sculpture from the series Pumpkin (1998) by Japanese artist Yayoi Kusama. Fetching $156,000 on 23 April 2019 at Phillips in New York, the piece, numbered 31/100, is a minor work by a major artist who has just recorded a new auction record at $8 million. But the seller acquired it 10 years ago at Christie’s in London (2009) for just $5,800 … one twenty-sixth of its current value.

This operation corresponds to an average annual return of +39% over ten years. By comparison, Apple’s share price (NASDAQ: AAPL) grew +26% per year over the same period, and the S&P 500 by +12% p.a..

Auction prices of Yayoi Kusama’s Pumpkin (1998) (edition of 100)

Sotheby’s withdraws from public scrutiny…

It’s a relatively common situation: an entity takes control of a company it considers to be underperforming… But the takeover of Sotheby’s – one of the world’s two giants of Fine Art sales, present in nine countries and alone generating 31% of global Fine Art auction turnover – illustrates a dilemma facing the entire auction industry.

From a technological point of view, the Art Market is several decades behind the rest of the economy. The rare attempts to bridge the gap (like the David Zwirner gallery’s “Basel Online” project) only serve to further highlight the difficulties the market’s big players are having migrating to an online environment. In 2017, Sotheby’s decided to eliminate buyer fees on its online sales, hoping to finally get them off the ground. But six months later, with no convincing results, the company reintroduced online sales fees.

In H1 2019 Sotheby’s posted a -7.4% contraction in Fine Art sales revenue versus H1 2018… after hammering the best result of the first semester: $110 million for Claude Monet’s Meules (1890).

Sotheby’s takeover offer by the telecoms and networks tycoon Patrick Drahi (with a premium of 61% over the averaged share price) has not only been very well received by the Sotheby’s management committee, it was also followed by two other offers (according to the New York Times): one from Wall Street, initiated by Blackstone CEO and art collector Stephen Schwarzman; the other from China’s Taikang Asset Management, which, until the operation is confirmed, holds the largest stake in Sotheby’s.

This financial interest underscores the immense economic potential identified by major European, American and Chinese investors. The withdrawal from a regulated public market will provide Sotheby’s with a greater degree of immunity from shareholder pressure, particularly regarding its operating margins. That will translate into greater flexibility which should allow Sotheby’s to pursue a long-term strategy that will almost certainly involve a faster and more intense drive towards the dematerialization of its activities, and therefore of the Art Market as a whole.

Methodology

The analysis of the Art Market presented in this report is based on auction results from public sales of Fine Art recorded by Artprice and Artron between 1 January 2019 and 30 June 2019.

This report only covers Fine Art works classified as paintings, sculptures, drawings, photographs, prints, videos, installations or tapestries, excluding antiques, anonymous cultural objects and furniture.

All prices indicated in this document refer to public auctions results, including buyer fees. The “$” symbol refers to the United States dollar.

Our ‘creative period’ segmentation obeys the following schema:

- “Old Masters” – works by artists born before 1759

- “19th century” – works by artists born between 1760 and 1859

- “Modern Art” – works by artists born between 1860 and 1919

- “Post-War Art” – works by artists born between 1920 and 1944

- “Contemporary Art” – works by artists born after 1945

30.6

30.6